The past few months have been quite the wild ride. I’ve purposely avoided discussing it all to ensure I can read widely and assess everything thoroughly before writing about it in depth here. I’d also like to thank all those who are not able to do their job from home and are thus, out there putting themselves at risk everyday to help us all stay safe from this virus.

The most recent similar event to the COVID-19 pandemic is probably the 1918 Spanish Flu and, like that previous outbreak, COVID-19 has also taken a horrific toll on lives globally. Today though, I want to focus more on the economics side of things.

This is because I am getting the distinct impression that few average people seem to really fully grasp the totality of the COVID-19 impact and what it will mean for the future. In my “Internet Bubble” – which I try and push out of as much as possible – most seem to be framing this pandemic as another financial crisis type event that’ll all be behind us soon enough.

In other words, they assume that things have “crashed” but will soon “spring back” or recover in a “V” shape. Just like in 2008 shares will go down… then rise back up once the economy is “restarted” like it’s some kind of industrial era engine.

I believe this is very, very wrong to assume for multiple reasons.

This Is A Natural Disaster, NOT A Financial Crash

It’s very easy for the media and most to look at the ASX300 or S&P500 and go wow! Check out the huge drop in share prices, the markets have crashed!!!

This then frames the conversation entirely around COVID-19 affecting the economy like all other previous financial style implosions. Whether it’s trading tulip bulbs or getting junk mortgage debt and selling it as AAA investments these economic crashes have been happening for hundreds of years are were due to economic reasons.

By contrast the economic impacts we’re witnessing today are due to a health emergency with real, physical world realities that you can’t just wave away with a new government law or stimulus package.

No matter what politicians think, you can’t just rewrite physics rules and make it go away, you can’t “bail out the Corona” and get everything moving quick smart. Physics DGAF and will keep doing what it’s doing.

So when the media covers the economy and reports on what it’s doing and why, it’s almost exclusively focused on this all being an economic problem with an economic situation and time frame. This misses a huge portion of the discussion as they’re all essentially talking about the wrong thing!

Recessions typically develop gradually over time, reflecting underlying economic and financial conditions, whereas the current economic situation developed suddenly as a consequence of a fast-moving global pandemic. A more appropriate comparison would be to a regional economy suffering the effects of a severe natural disaster, like Louisiana after Hurricane Katrina or Puerto Rico after Hurricane Maria.

newyorkfed.org

The below graph of cumulative jobless claims – from the USA – gives a very clear picture of how the impact of the Coronavirus should clearly not be likened to a typical financial recession.

As such, the only rational response is to reassess the economic fallout and consequences as if this is some kind of world wide natural disaster. Essentially think about it like having every major city world wide being hit by a Category 5 Hurricane… all at once… that’s really slow moving and that we have no idea when it will be “gone”. Fun times!

Generating Real World Data Takes Time

So we’ve shown that this is not a financial crash but instead, basically a world wide disaster which means the next step is to assess its impact and calculate what businesses economic outlooks are going to be.

Maybe they had forecast a 25% profit for the next quarter, how does this impact change those forecasts? Once this new forecast is calculated then investors can get a better idea of what their future earnings will be and thus, how much their shares or company should be valued at.

The problem is that generating these forecasts naturally should be done on their historic data. If you had $1,000,000 in profits last quarter and the Q2 is usually 25% better than Q1 then you would normally estimate $1,250,000 in profits for Q2.

Obviously that isn’t going to be the case for any airlines or restaurants given all the lock downs so what should they change their figures to? Unfortunately this “unprecedented” situation means they basically have no idea. Maybe things go bonkers because everyone is hoarding toilet paper. Maybe the government bans all international travel and all your planes get grounded. Perhaps this only lasts for 1 month… then again it could go on for 6, no one knows.

As such businesses must wait to see real world data on what happens during Q2 in order to have any hope at all of forecasting earnings. This also means that they literally have no idea how bad it will be. They might be able to see their own data in real time, but with the governments changing laws rapidly and consumers also changing what they’re comfortable doing too it’s a highly volatile world right now.

Add on to all of this you have the potential that any business might go under at any time due to all the stresses. Businesses can’t see other companies internal data so they might assume one of their main customers is fine… until whoops they’re not and there goes a huge portion of their revenue.

A very vivid description of this I read recently was “a cascading wave of garbage”. Companies go under which puts stress on others which then also go bankrupt too. Others simply just don’t have enough cash reserves to maintain the levels at which they’re being effected and go belly up.

The result is that not only will it take a full quarter of “earnings” to at least semi-properly figure out how this will all effect businesses, but that in the mean time all the debt and bankruptcies are ploughing through companies one after the other making even those forecasts shaky at best.

This theme I’m seeing of people assuming it’ll all “recover quickly” or that the worst is over I believe is wrong simply because no company knows how they have been affected yet. Everyone seems to think that the initial crash was the main show and now we’re already starting to build things back up again. When in fact, we still don’t know how everything has been fully affected and things are still crashing all around us!

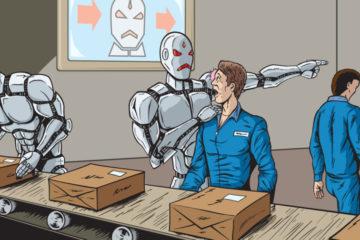

We’re All Connected

This cascading wave of garbage is, ironically, like a virus to the economy that spreads rapidly from one business to the next. You have the patient zero – say an airline for instance – that is directly impacted by a government lock down of the borders.

From here their flights drop 99% and revenue hits the floor. Expenses still exist though and so they’re bleeding money and burning through whatever cash reserves they have fast. Eventually they can’t take it anymore and go bankrupt but that isn’t the end of it.

All the other businesses and industries that support and depend on the airlines as a customer take a massive hit. Maybe that airline was 75% of your orders if you supply them with aviation fuel or tyres for their planes. Now your company is burning through its cash reserves and going bankrupt too.

Meanwhile the flight booking businesses are facing the same situation, as are the hotels and all the other tourist related theme parks, hot spots and so on. Ripples extend even further from them as commodities like soaps or food are no longer needed now that no one is staying in hotels or eating at restaurants and you can see why this is not only bad, but takes time to play out.

You cannot “assess” this type of multi-layered bankruptcy wave in a few days or a week. Getting the real world business data takes time. Having company after company succumb to the lower revenues and finally going under also takes time. This then starts the chain again for the next wave and we’re talking about months and months of successive bankruptcies and job losses.

It even comes around full circle eventually impacting the governments own balance sheet. They’re already realising this as they see house sale rates plummet which means stamp duty revenues also go down leading to councils having to either run off cash reserves or cut back spending somehow. Essentially “their” problems are everyone’s problems.

This Won’t Be Over Soon

This rhetoric of assuming everything will “bounce back” or go in a “V” shape also assumes that everything will instantly return to 100% normal – or something close to it – again once they remove the lock downs.

This once again seems unlikely for two main reasons. First, unless we somehow have a cure or vaccine be produced for it ASAP it’s likely restrictions in some form or another will be around for many, many months. This will impact different industries and companies differently but as noted, their problems are everyone’s problems.

While the impact lessens as the degrees of separation increase from the impacted area, they’re still there and still dramatic given most businesses barely have a month of cash reserves, operate on margins of 5-12% and will have already been severely pushed up against the wall from months of full lock down.

Your business might supply the parts that keep the refineries going that make the jet fuel that planes run on. Maybe the hit isn’t so bad from planes all being grounded to you and your profits only decline 15% rather than 99% like the airlines. However after 3 months of full lock downs then another 6… 9… 12 months of partial lock down measures you just can’t stay afloat anymore. This isn’t like ripping a band-aid off for companies, a one time “pain” then back to normal again. This is a slow, painful marathon (so really like any marathon ha!).

The second reason things won’t just “bounce back” is because even if we did somehow magically have a 100% working cure/vaccine already out in a few months companies will likely have huge debts now weighing them down. During this crisis many are and will continue to borrow to help pay for their expenses while their revenue isn’t enough.

Think of it like taking out a credit card loan to pay your power bills at home because you’ve lost your job. After a few months of this you get a new job and your income returns but you still have that $20,000 in CC debt. You’re not going to be spending money at the same rate as before because you’ll have to pay down that debt now too. Companies will be the same and it will take them years.

Conclusions

So this pandemic is more like a global natural disaster than a financial crash. It will take at least until the end of June to properly calculate and see real world data on how the world is reacting financially speaking and even then, the cascade of defaults, garbage and volatility everywhere means stocks are going to be all over the place.

From June, social distancing and restrictions may slowly lift assuming it all keeps improving and these will likely continue until a long term solution is found like a proven vaccine. Initial estimates put a vaccine at 12-18 months just FYI.

So the cascading default could still be continuing on until June 2021. Then, after a long term solution is found and things return to normal most companies – and many people – will have a massive debt hang over that’ll retard their spending or investment for another 1-4 years beyond that.

As said, this is a marathon. Now is not the time for thinking it’s “almost over” or that “we’ll be back to normal next month”. I expect things to continue going the way we’ve been seeing with companies going under and SHTF regularly. If this impacts the Christmas time sales in countries that have their Winter during this time there will be an even bigger wave there. So what’s the best thing to do right now?

Hustle.

Hustle and save.

Then hustle and save some more.

Get those expenses lower. Work on increasing that side income. Start two new forms of side income. Maybe invest in a new solar system that’ll generate passive income for you.

But don’t get complacent. At the top of our finances spreadsheet I’ve long had the following and it’s more important now than ever I think: ZERO ARROGANCE, MAXIMUM DISCIPLINE.

Please note the above are my own personal opinions and in no way constitute financial advice. Please seek a qualified financial planner before making any financial decisions of your own.

The benefits include: 1) How to get those silky smooth videos that everyone loves to watch, even if you're new 2) How to fly your drone, from taking off to the most advanced flight modes 3) Clear outlines of how to fly with step-by-step instructional demonstrations and more 4) Why flying indoors often results in new pilots crashing their drone 5) What other great 3rd party apps are out there to get the most out of your drone 6) A huge mistake many pilots make when storing their drone in the car and how to avoid it 7) How to do all of these things whilst flying safely and within your countries laws.